Tax

Working with you to manage your tax affairs

In today’s business environment, tax is front-page news across the world. Tax rules can be complex and with what seems like an ever-increasing speed of change, it can be hard to keep on top of your obligations. Effective tax advice and planning can therefore put you and your business in the strongest commercial position.

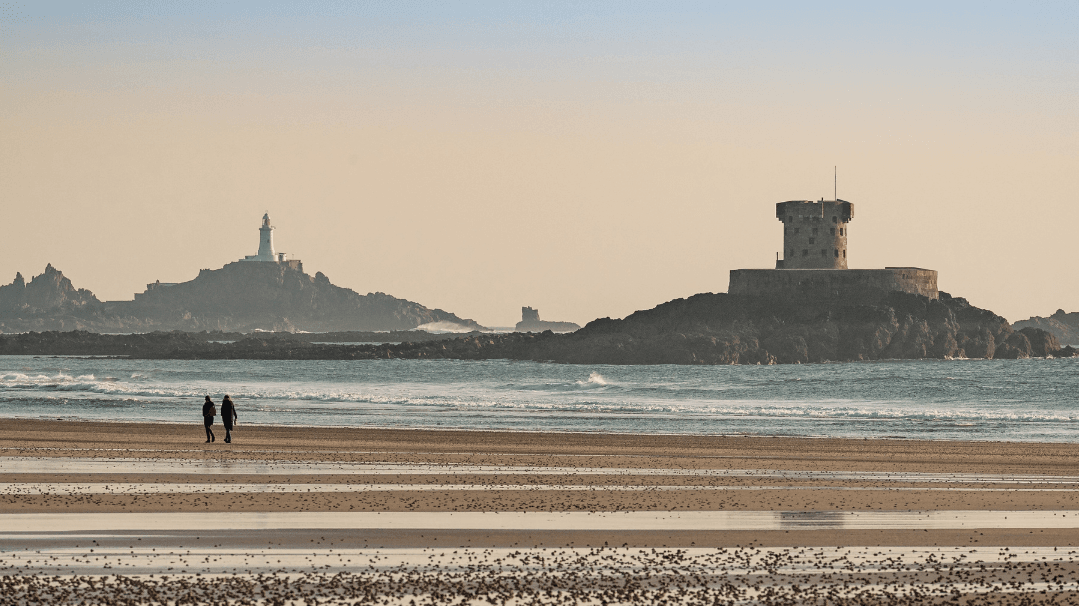

Jersey and Guernsey (the Islands) provide a tax neutral environment with support from a wide range of financial services professionals. Allow us to take care of your tax requirements and help navigate the changing tax landscape leaving you to focus on the development and expansion of your business for the benefit of shareholders and investors.

"I have been very impressed with the level of service and expertise that Baker Tilly Channel Islands have given us over the course of our relationship to date. They have provided us with invaluable advice and guidance to ensure compliance with our regulatory and legal responsibilities."

Why Jersey or Guernsey?

- Strong regulatory framework

- Variety of corporate vehicles, including

- Company

- Protected Cell Company / Incorporated Cell Company

- Limited Partnership

- Separate Limited Partnership / Incorporated Limited Partnership

- Limited Liability Company

- Limited Liability Partnership

- Property Unit Trust

- Foundation

- Trust

- Tax neutrality;

- low domestic tax rates

- no stamp duty on transfer of shares

- no capital taxes regime

- no withholding tax (to foreign shareholders)

- Access to the International Stock Exchange via local listing agents (including listing Eurobonds, UK Real Estate Investment Trusts)

- Flexible corporate law for distributions to shareholders amongst other benefits

- No requirement to file publicly available financial statements (unless a public company)

- Access to a wide range of professionals – fiduciary services providers, financial professionals

- Time zone and transport links to London over other international finance centres;

Speak to our team of Tax advisors